Australian gambling and wagering organisations face layers of highly complex regulations, compliance, and technology ecosystems. With multiple regulators, changing legislation, and increasingly sophisticated cyber risks, these organisations need to protect themselves and their punters.

Payments is one area of opportunity when tackling these challenges. In 2022-2024, over $244 billion was transacted in the gambling and wagering industry1. As Australia's payments infrastructure moves to be digital first, there are new technologies enabling greater protections for punters and organisations alike.

Here are some of the latest technologies in payments and how they improve punter experience, fraud prevention, and compliance.

How Technology Supports Compliance & Responsible Gambling

The Australian Communications and Media Authority (ACMA) operates at the federal level and maintains a register of licensed wagering providers and implemented BetStop in 2023. BetStop manages the National Self-Exclusion Register, a way for individuals to better manage their participation in online wagering. If an individual has placed themselves on the register, wagering providers will refuse them service.

In some instances, an individual who has placed themselves on the self-exclusion register may attempt to create a new account under a different name. To detect the true ownership of the account, the source of funds linked to the account can be used to verify and whitelist those users according to the registry.

Offering digital-first payment methods comes with a high level of transparency and automation. If an individual has attempted to fund an account while on the registry, custom automations can instantly reject and return the funds. This protects both the user and the wagering organisation from breaching the terms of the registry.

Custom automations can also be set up for punters to practise responsible gambling. By setting maximum deposit limits, punters limit their risk and reconciliation rules can reject any funds that exceed the maximum set.

Fraud Prevention in Wagering Payments

The punter's experience starts with setting up and funding an account, and ends with withdrawing their earnings

The payout process needs strong anti-fraud and AML protections in place. As a high-value target, wagering wallets can experience sophisticated cyber-attack attempts. Bad faith actors may gain access to an account and change the destination of payouts, or attempt to use wagering platforms for money laundering.

Monoova layers a number of protections to provide security to both punters and wagering organisations. Here’s how:

Transaction monitoring

Transaction monitoring is key for AML and anti-fraud best practice. Whitelisting accounts, real-time visibility over payments, and traceability of funds sources all protect both the punter and the wagering organisation.

Confirmation of Payee

Confirmation of Payee (CoP) is a recent feature that checks the recipient's details when making payments via BSB and account number.

When new punters are signing up, it helps to ensure they aren’t being tricked by someone impersonating a legitimate business. For the wagering business, it’s an added layer of confirmation before releasing a withdrawal. If someone has gained access to a punter’s account and changed the destination for a payout, CoP can flag this before approving the release of funds.

3-D Secure for card payments

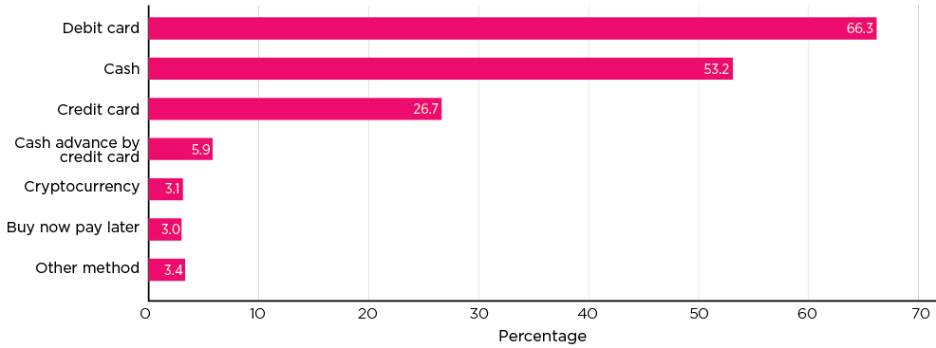

Over 66% of punters reported using debit cards2 to fund online bets, the number one payment method. For punters funding their accounts with debit cards, 3-D Secure authenticates the user and authorises the payment.

Graph: Gambling payment methods used by regular online bettors in the past 12 months (2022). 1

Instant payments for account funding and payouts

New payment rails such as PayTo are instantaneous and are used both for account funding and paying out earnings.

Getting funds back to punters in seconds provides a first-class product experience and reduces customer support enquiries regarding payment statuses.

For any concerns that do pop up, Monoova’s support team is Australia-based and comprised of experienced payments experts.

The future of cashless payments in gaming

Digital payments are rolling out beyond just online wagering platforms. In NSW, the state government has recommended a mandatory statewide account-based gaming system to be implemented by 20283. This could see gaming machines be converted to accept non-cash payments and link these payments to an account.

While NSW has the largest number of gaming machines, other states may follow suit given the built-in protections and responsible gambling tools for punters.

Partner with Monoova for Secure Wagering Payments

As wagering regulations tighten and payment technology evolves, staying ahead of compliance and punter protection is critical. By adopting secure, digital-first payment solutions, wagering providers can enhance customer experience, prevent fraud, and meet regulatory requirements —all while safeguarding their business and punters. Partner with Monoova for secure wagering payments that protect punters, ensure compliance, and move money faster. Speak to our wagering payment experts today.

FAQ Section

Q1: What are the key payment trends for wagering in 2025?

In 2025, payment trends in wagering include digital-first methods like PayTo, enhanced fraud protection with transaction monitoring, and tools supporting responsible gambling.

Q2: How do digital payments improve punter protection?

Digital payments offer transparency, enable real-time transaction monitoring, and allow automations like deposit limits and source account verification - helping protect both punters and wagering organisations.

Q3: What is BetStop and why is it important for compliance?

BetStop is Australia’s National Self-Exclusion Register, helping individuals manage their gambling activities. Wagering providers must comply with BetStop by ensuring self-excluded individuals cannot open or fund accounts.

Q4: How can wagering providers prevent fraud in payouts?

By using features like Confirmation of Payee, 3-D Secure for card payments, and real-time monitoring, wagering providers can protect against payout fraud and account tampering.

.jpg)

.png)

.png)